Embedded with Creditsafe's 430M+ company reports across 200 countries & territories. Experience automated, real-time Monitoring, Credit Reports, business and individual AML/KYC screening, Check & Decide Decision Models, and world-class support.

From a single customer interaction gather real-time, verified, trusted data and decisons.

Send Your Microsite Link

As soon as your customer starts onboarding via our Microsite, automated processes begin monitoring and triggering the necessary actions.

AI Agents & Triggers

Records & Integrations

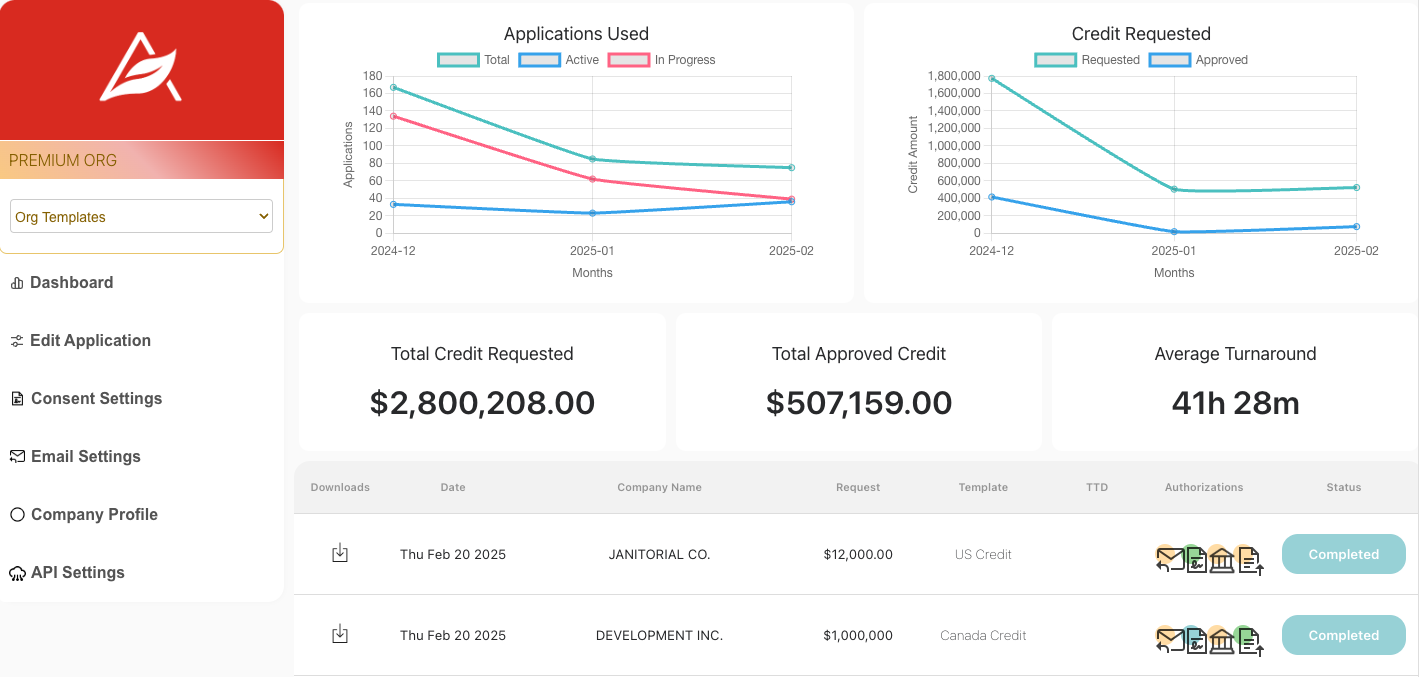

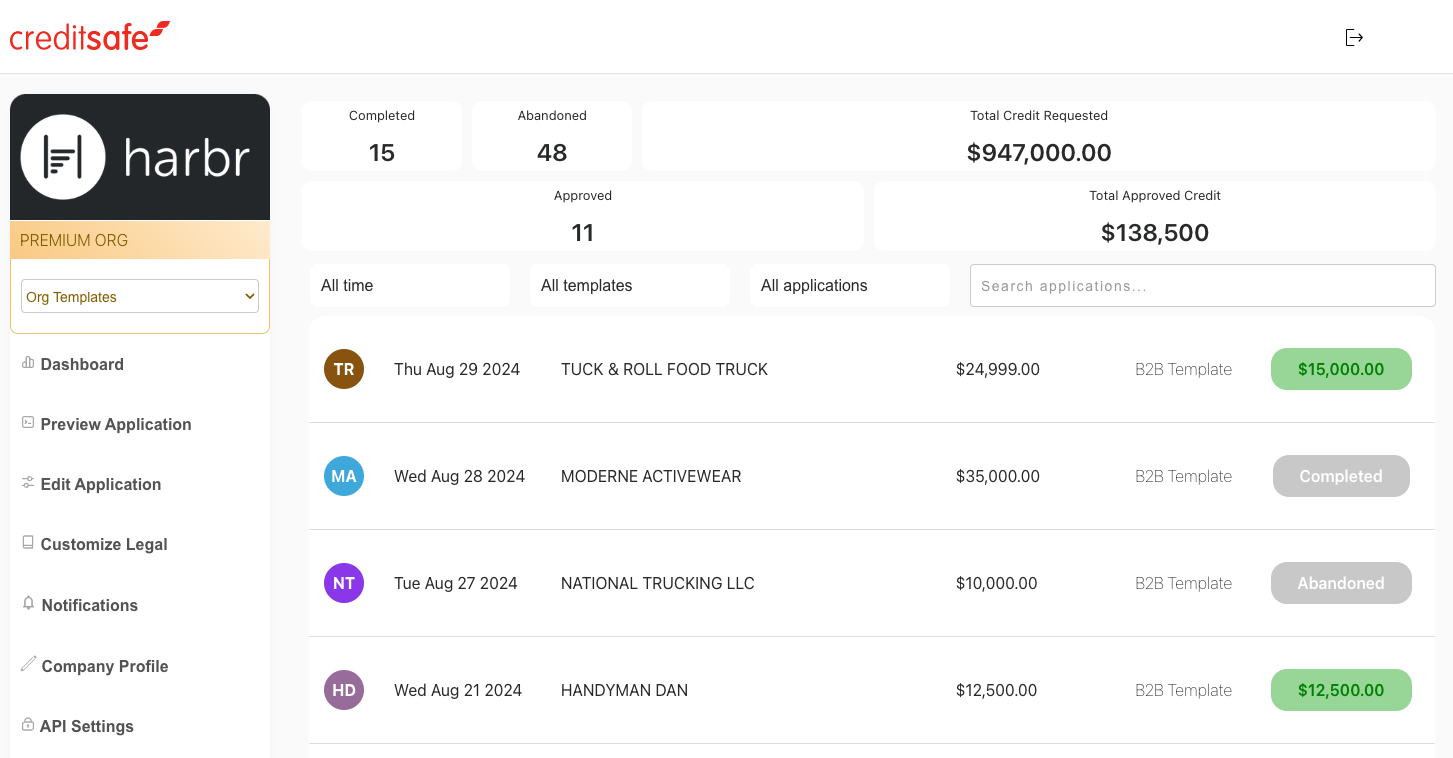

Raw data and analysis results are delivered straight to your inbox, integrated with your ERP or CRM, and always accessible within your Harbr Credit Onboarding Platform.

Ready to transform your credit operations?

Schedule a personalized demo today.

Harbr pairs powerful automation with exceptional customer support. Our team is responsive, knowledgeable, and invested in your success—ensuring you get guidance whenever you need it. With Harbr, you’re not just using a platform; you have a trusted partner by your side.